Skillsoft Reports Strong Financial Results for the Third Quarter of Fiscal 2022

Extends Leadership Position with New Customer Wins and Significant Product Momentum with Percipio Bookings up 60%

BOSTON-- Skillsoft Corp. (NYSE: SKIL) (“Skillsoft” or the “Company”), a global leader in corporate digital learning, today announced its financial results for the third quarter of fiscal 2022 ended October 31, 2021. The Company delivered bookings growth in each of its business segments and grew revenue. Skillsoft raised its full year outlook for bookings and adjusted revenue and updated its outlook for adjusted EBITDA to the midpoint of the previous range.

“We delivered another strong quarter, driving bookings and adjusted revenue growth above expectations and executing on our strategic priorities,” said Jeffrey R. Tarr, Skillsoft’s Chief Executive Officer. “We grew each of our segments, won new blue-chip customers and advanced our migration to Percipio. We also signed new strategic alliances and launched new content and platform features, further increasing the value we deliver to our customers.”

Mr. Tarr added, “In our first two quarters as a public company, we recapitalized the business, assembled a world-class management team and board of directors, completed two acquisitions, and made foundational investments in content, platform and go-to-market. We continue to advance our vision of being the most highly valued provider of learning solutions and preparing the workforce of today with the skills for tomorrow.”

Updated Full Year Fiscal 2022 Outlook1

Skillsoft increased its bookings and adjusted revenue outlook for full year fiscal 2022 primarily to reflect better than expected performance through the first three quarters of the year.

The adjusted EBITDA outlook at the middle of the original outlook range reflects the Company’s growth investments in content, platform, and go-to-market capabilities, contributing to the higher than expected bookings and adjusted revenue growth.

Fiscal 2022 Third Quarter Financial Highlights2

- Grew bookings 7%, with Content up 6%, Global Knowledge up 11%, Content and Global Knowledge combined up 8% and SumTotal up 3%;

- Delivered GAAP revenue for the reported period of $171 million and GAAP net loss of $43 million;

- Grew adjusted revenue3 6% to $179 million with adjusted EBITDA3 of $49 million, in line with the prior year due to growth investment, synergy timing related to the delay in the closing of the Global Knowledge transaction, and higher D&O insurance costs;

- Delivered combined Percipio and dual deployment dollar retention rate of 101%; and

- Advanced platform migration to Percipio, with 86% of Skillsoft Content annual recurring revenue on Percipio or Percipio dual deployment, up from 81% last quarter and 68% in the prior year period.

Key Operational Metrics and Non-GAAP Financial Measures

Bookings (previously Order Intake)

The following table sets forth unaudited bookings for the three and nine months ended October 31, 2021 and 2020 as if pre-combination Skillsoft and Global Knowledge had been combined and their fiscal quarters had been aligned to end on October 31:

Dollar Retention Rate

The following table sets forth dollar retention rates (“DRR”) for the last twelve month (“LTM”) period ended October 31, 2021 and for the three month periods ended October 31, 2021 and 2020 as if Skillsoft and Global Knowledge had been combined and their fiscal quarters had been aligned to end on October 31:

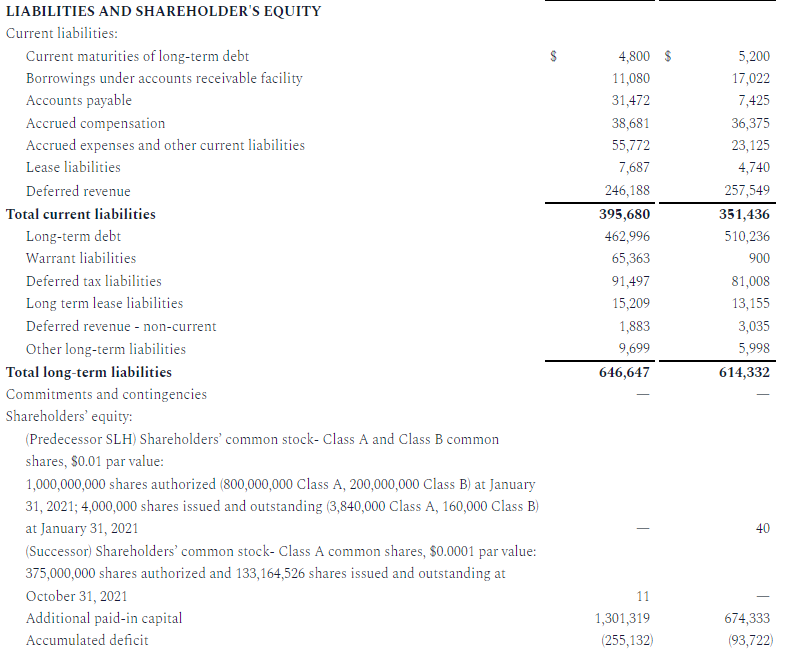

The following table sets forth Skillsoft’s cash and cash equivalents and long-term debt as of October 31, 2021:

Weighted average shares outstanding during the period from July 31, 2021 to October 31, 2021 were 133,116,361.

Webcast and Conference Call Information

Skillsoft will

host a conference call and webcast today at 5:00 p.m. Eastern Time to

discuss its financial results. To access the call, dial (877) 413-9278

from the United States and Canada or (215) 268-9914 from international

locations. The live event can be accessed from the Investor Relations

section of Skillsoft’s website at investor.skillsoft.com. A replay will be available for six months.

About Skillsoft

Skillsoft (NYSE: SKIL) is a global leader

in corporate digital learning, focused on transforming today’s workforce

for tomorrow’s economy. The Company provides enterprise learning

solutions designed to prepare organizations for the future of work,

overcome critical skill gaps, drive demonstrable behavior-change, and

unlock the potential in their people. Skillsoft offers a comprehensive

suite of premium, original, and authorized partner content, including

one of the broadest and deepest libraries of leadership & business

skills, technology & developer, and compliance curricula. With

access to a broad spectrum of learning options (including video, audio,

books, bootcamps, live events, and practice labs), organizations can

meaningfully increase learner engagement and retention. Skillsoft’s

offerings are delivered through Percipio, its award-winning, AI-driven,

immersive learning platform purpose built to make learning easier, more

accessible, and more effective. Learn more at www.skillsoft.com.

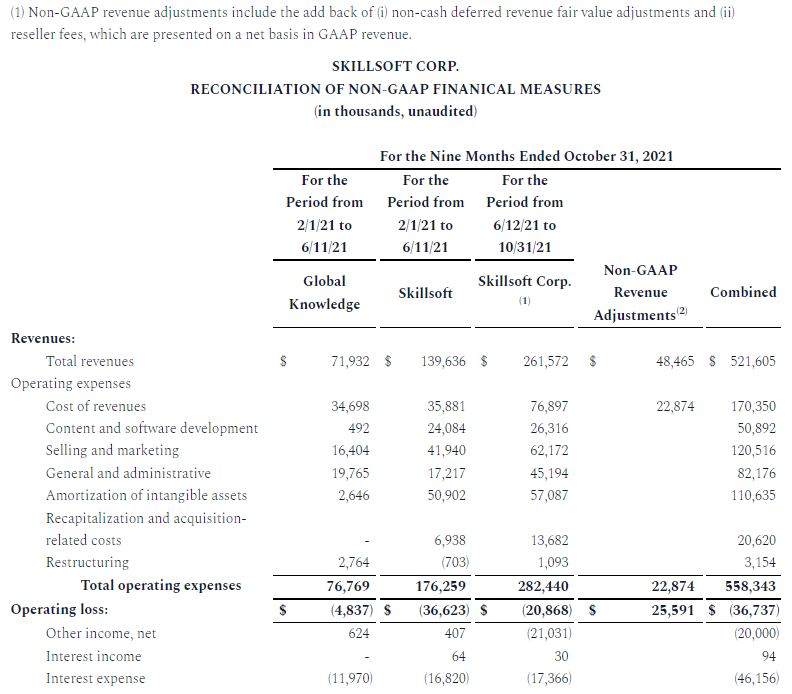

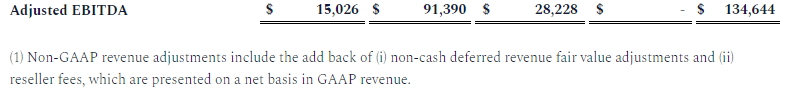

NON-GAAP FINANCIAL MEASURES AND KEY PERFORMANCE METRICS

We

track several non-GAAP financial measures and key performance metrics

that we believe are key financial measures of our success. Non-GAAP

measures and key performance metrics are frequently used by securities

analysts, investors, and other interested parties in their evaluation of

companies comparable to us, many of which present non-GAAP measures and

key performance metrics when reporting their results. These measures

can be useful in evaluating our performance against our peer companies

because we believe the measures provide users with valuable insight into

key components of U.S. GAAP financial disclosures. For example, a

company with higher U.S. GAAP net income may not be as appealing to

investors if its net income is more heavily comprised of gains on asset

sales. Likewise, excluding the effects of interest income and expense

moderates the impact of a company’s capital structure on its

performance. However, non-GAAP measures and key performance metrics have

limitations as analytical tools. Because not all companies use

identical calculations, our presentation of non-GAAP financial measures

and key performance metrics may not be comparable to other similarly

titled measures of other companies. They are not presentations made in

accordance with U.S. GAAP, are not measures of financial condition or

liquidity, and should not be considered as an alternative to profit or

loss for the period determined in accordance with U.S. GAAP or operating

cash flows determined in accordance with U.S. GAAP. As a result, these

performance measures should not be considered in isolation from, or as a

substitute analysis for, results of operations as determined in

accordance with U.S. GAAP.

We do not reconcile our forward-looking non-GAAP financial measures to the corresponding U.S. GAAP measures, due to variability and difficulty in making accurate forecasts and projections and/or certain information not being ascertainable or accessible; and because not all of the information necessary for a quantitative reconciliation of these forward-looking non-GAAP financial measures to the most directly comparable U.S. GAAP financial measure is available to us without unreasonable efforts. For the same reasons, we are unable to address the probable significance of the unavailable information. We provide non-GAAP financial measures that we believe will be achieved, however we cannot accurately predict all of the components of the adjusted calculations and the U.S. GAAP measures may be materially different than the non-GAAP measures.

Forward Looking Statements

This document includes

statements that are, or may be deemed to be, “forward-looking

statements” within the meaning of Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended, which are intended to be covered by the safe harbors

created by those laws. These forward-looking statements include

information about possible or assumed future results of our operations.

All statements, other than statements of historical facts, that address

activities, events or developments that we expect or anticipate may

occur in the future, including such things as our outlook (including

bookings, adjusted revenue and adjusted EBITDA), our product development

and planning, our pipeline, future capital expenditures, financial

results, the impact of regulatory changes, existing and evolving

business strategies and acquisitions and dispositions, demand for our

services and competitive strengths, goals, the benefits of new

initiatives, growth of our business and operations, our ability to

successfully implement our plans, strategies, objectives, expectations

and intentions are forward-looking statements. Also, when we use words

such as “may,” “will,” “would,” “anticipate,” “believe,” “estimate,”

“expect,” “intend,” “plan,” “projects,” “forecasts,” “seeks,” “outlook,”

“target,” goals,” “probably,” or similar expressions, we are making

forward-looking statements. Such statements are based upon the current

beliefs and expectations of Skillsoft’s management and are subject to

significant risks and uncertainties. Actual results may differ from

those set forth in the forward-looking statements. All forward-looking

disclosure is speculative by its nature.

There are important risks, uncertainties, events and factors that could cause our actual results or performance to differ materially from those in the forward-looking statements contained in this document, including:

- our ability to realize the benefits expected from the business combination between Skillsoft, Churchill Capital Corp. II and Global Knowledge;

- the impact of changes in consumer spending patterns, consumer preferences, local, regional and national economic conditions, crime, weather, demographic trends and employee availability;

- the impact of the ongoing COVID-19 pandemic (including any variant) on our business, operating results and financial condition;

- fluctuations in our future operating results;

- our ability to successfully identify, consummate and achieve strategic objectives in connection with our acquisition opportunities and realize the benefits expected from the acquisition;

- the demand for, and acceptance of, our products and for cloud-based technology learning solutions in general;

- our ability to compete successfully in competitive markets and changes in the competitive environment in our industry and the markets in which we operate;

- our ability to market existing products and develop new products;

- a failure of our information technology infrastructure or any significant breach of security, including in relation to the migration of our key platforms from our systems to cloud storage;

- future regulatory, judicial and legislative changes in our industry;

- our ability to comply with laws and regulations applicable to our business;

- the impact of natural disasters, public health crises, political crises, or other catastrophic events;

- our ability to attract and retain key employees and qualified technical and sales personnel;

- fluctuations in foreign currency exchange rates;

- our ability to protect or obtain intellectual property rights;

- our ability to raise additional capital;

- the impact of our indebtedness on our financial position and operating flexibility;

- our ability to meet future liquidity requirements and comply with restrictive covenants related to long-term indebtedness;

- our ability to successfully defend ourselves in legal proceedings; and

- our ability to continue to meet applicable listing standards.

The foregoing list of factors is not exhaustive and new factors may emerge from time to time that could also affect actual performance and results. For more information, please see the risk factors included in the Company’s S-1 amendment filed on July 29, 2021 and subsequent filings with the SEC.

Although we believe that the assumptions underlying our forward-looking statements are reasonable, any of these assumptions, and therefore also the forward-looking statements based on these assumptions, could themselves prove to be inaccurate. Given the significant uncertainties inherent in the forward-looking statements included in this document, our inclusion of this information is not a representation or guarantee by us that our objectives and plans will be achieved. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. Additionally, statements as to market share, industry data and our market position are based on the most currently available data available to us and our estimates regarding market position or other industry data included in this document or otherwise discussed by us involve risks and uncertainties and are subject to change based on various factors, including as set forth above.

Our forward-looking statements speak only as of the date made and we will not update these forward-looking statements unless required by applicable law. With regard to these risks, uncertainties and assumptions, the forward-looking events discussed in this document may not occur, and we caution you against unduly relying on these forward-looking statements.

1 See “Non-GAAP Financial Measures and Key Performance Metrics.” The Company does not reconcile forward-looking non-GAAP measures.

2 Growth calculated compared to the prior year as if pre-combination Skillsoft and Global Knowledge had been combined and their fiscal quarters had been aligned to end on October 31, 2021.

3 Signifies non-GAAP measure. See “Non-GAAP Financial Measures and Key Performance Metrics” in this release.

Key Performance Metrics

We use key performance metrics to help us evaluate our performance and make strategic decisions. Additionally, we believe these metrics are useful as a supplement to investors in evaluating the Company’s ongoing operational performance and trends. These key performance metrics are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similarly titled metrics presented by other companies.

Annualized Recurring Revenue (“ARR”)

ARR represents the annualized recurring value of all active subscription contracts at the end of a reporting period. We believe ARR is useful for assessing the performance of our recurring subscription revenue base and identifying trends affecting our business.

Dollar Retention Rate (“DRR”)

For existing customers at the beginning of a given period, DRR represents subscription renewals, upgrades, churn, and downgrades in such period divided by the beginning total renewable base for such customers for such period. Renewals reflect customers who renew their subscription, inclusive of auto-renewals for multi-year contracts, while churn reflects customers who choose to not renew their subscription. Upgrades include orders from customers that purchase additional licenses or content (e.g., a new Leadership and Business module), while downgrades reflect customers electing to decrease the number of licenses or reduce the size of their content package. Upgrades and downgrades also reflect changes in pricing. We use our DRR to measure the long-term value of customer contracts as well as our ability to retain and expand the revenue generated from our existing customers.

Bookings

Bookings (previously referred to as order intake) in any particular period represents orders received during that period and reflects (i) subscription renewals, upgrades, churn, and downgrades to existing customers, (ii) non- subscription services, and (iii) sales to new customers. Bookings generally represents a customer’s annual obligation (versus the life of the contract), and, for the subscription business, revenue is recognized for such bookings over the following 12 months. We use bookings to measure and monitor current period business activity with respect to our ability to sell subscriptions and services to our platform.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211213005985/en/

Investors

James Gruskin

james.gruskin@skillsoft.com

Media

Caitlin Leddy

caitlin.leddy@skillsoft.com

Source: Skillsoft Corp.

Released December 14, 2021